The financial results for the past three months of Sony Corp. were released today, forecasting a net loss of 110bn yen ($1.1bn) for the financial year ending March. This a revision downward from a previous prospect of 30bn yen profit.

The company reported a significant boost to sales and operating income, lifting the stock price. PS4 and Xperia smartphone and tablet sales were strong, as expected. All segments reported increased year-on-year sales and operating revenue, except for devices.

Sony has bit the bullet and sold of it’s PC business and is pushing out the TV division to a wholly-owned subsidary. This leads to impairment charges and write-offs with 5,000 job cuts planned before the end of the 2014 financial year. The PC business is sold to Japan Industrial Partners Inc. to “enhance the autonomy of the business”.

Read on the for full story.

News in 15 Seconds: Game and Mobile are up, leading with whopping sales and income, other divisions reporting modest rises both for this quarter and for the year so far, except devices. PC business being sold off, TV business being detached to a fully owned subsidiary, 5000 jobs to be cut.

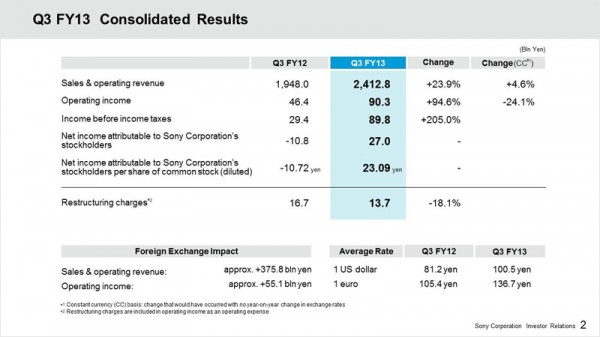

Sales and Operating Income

Taking a look at the figures, there is plenty of good news. Sales and operating income are up 24% in this quarter year-on-year with a near doubling of operating income to 90bn yen. Sales do pay for cost of sales with income before taxes also up, by a whopping 205%. Stockholders will be pleased to see a sharp swing back to net income too.

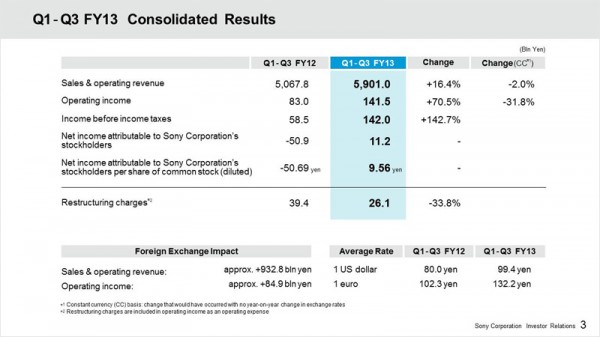

To recap on performance for the first three quarters of this financial year, the surprisingly cool Q2 FY13 results didn’t hold back the company from an upswing in sales, operating income and net income. The three quarters this year register a 16% sales and operating income rise with a 70% rise in operating income. Taxes before income are still impressive at a 142% YoY rise. Stockholders will notice a sharp comeback from FY12 net income.

Unfortunately, to make the cut from the PC division and push out the TV division, job cuts were announced:

Due to the implementation of the above measures across Sony’s TV and PC businesses, and its manufacturing, sales and headquarters/indirect functions, Sony is anticipating headcount reduction of approximately 5,000 (1,500 in Japan, 3,500 overseas) by the end of FY14.

News Release, February 6, 2014

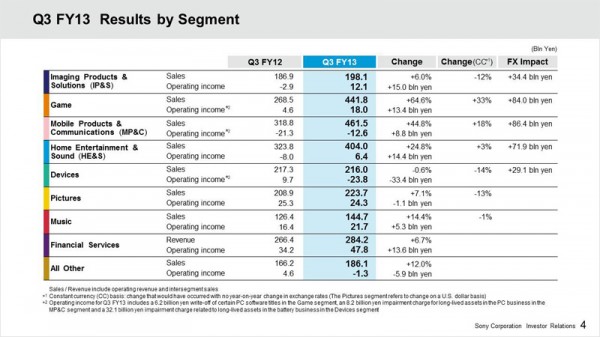

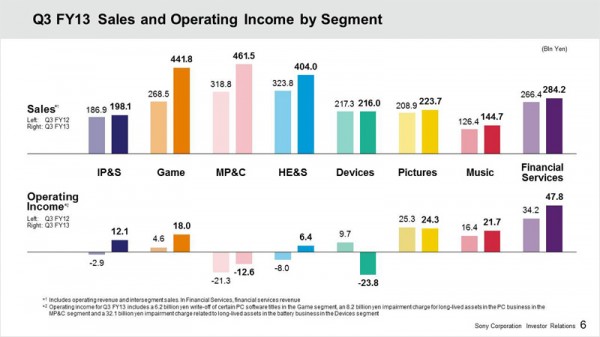

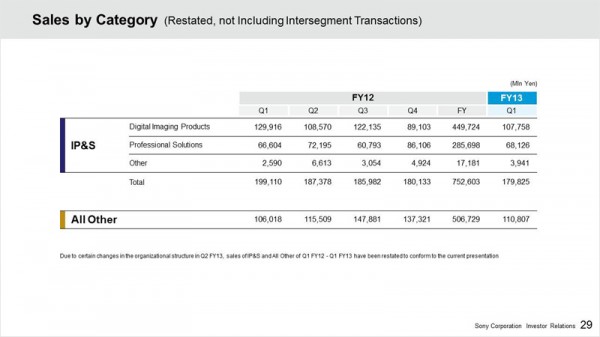

Results by Segment, Sales & Operating Revenue

Game – Registered a 64% rise YoY to 441bn yen. When the impact of currency change is removed, the rise is 33%.

Mobile – A surge of 44% to 461bn yen. FX change considered, that’s an 18% YoY rise.

Home Entertainment – The third largest rise on this quarter’s results YoY, a 24.8% increase.

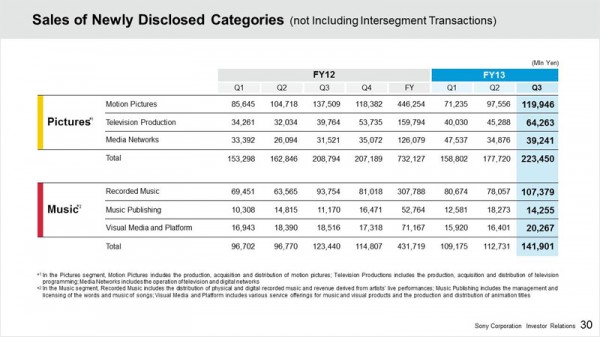

Music – A rise of 14% to 144bn yen. This segment has been stable in FY13.

Pictures – Another division to watch, a rise of 7.1% was reported on the same quarter last year.

Imaging – Another delicate segment, produced a 6% rise YoY at a 198bn yen.

Financial Services – A newer division, reported a 6.7% increase YoY to 284bn yen.

All Other – A 12% rise to 186bn yen.

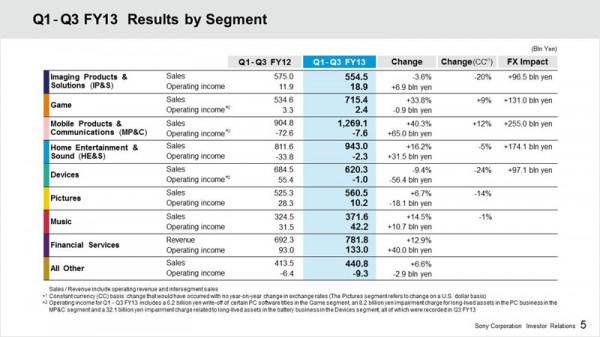

For Q1-Q3 FY13 vs FY12, the trend continues, with Game and Mobile leading the pack, backed by modest gains elsewhere. The exception continues to be the Devices division.

For more visual readers, here is the Q3 FY13 results vs Q3 FY12 as a bar chart:

Results Forecast: Impairment Charges, Asset Sale (Q3 Results Compared with October Forecast)

Sales in the Music and Financial Services segments will exceed expectations made in October, Mobile (including PC) and Home Entertainment are below the October forecast.

Consolidated operating income is down from 170bn to 80bn yen.

Several expenses have accrued which were not present in October and a boost from an asset sale has “been reconsidered”.

- An impairment charge is recorded related to the battery business, a part of Devices worth 32bn yen / $306m USD

- 8.2bn / $78m USD impairment charge registered for the PC business, a part of Mobile

- A PC software (recorded in the Game segment, though PC is a part of Mobile) impairment charge of 6.2bn yen / $59 USD

- A 20bn yen increase in expected restructuring costs to 70bn

The increase of 20 billion yen in the current fiscal year is due to the implementation of certain measures to mainly address Sony’s reforming of its PC and Television business, as announced today, February 6, 2014.

The Next Quarter, Completing the FY13: Forecast by Segment

Imaging Products & Solutions – Flat sales but a small increase in operating revenue YoY. Operating income up from October forecast due to cost reductions.

…production capacity for image sensors is being increased in response to strong demand for image sensors for smartphones and tablets…working together in both hardware and software to create and promote 4K…

Game – Sales on target with October forecast, operating results up slightly, benefiting from cost reductions. YoY sales are expected to increase significantly, though operating results are expected to decline significantly.

There was also a dramatic increase in the number of members of PlayStation Plus…service.

Mobile Products & Communications – A downward revision in sales of smartphones from the October forecast, but full year sales and income are expected to rise significantly.

…Relationships with telecommunications carriers across the globe are being strengthened….increasing connectivity with televisions and gaming devices and strengthening the link with motion picture, television, music and game content.

Regarding the TV business, profitability has improved significantly over the last two years, however Sony now anticipates its target of returning this business to profitability will not be achieved within the current fiscal year.

Regarding the PC business, Sony has decided to cease the business as the global PC industry is undergoing structural changes among other factors, and has concluded a memorandum of understanding with Japan Industrial Partners Inc. to sell the business.

Home Entertainment & Sound – Sales and income down from the October forecast, full year expected to rise significantly.

Devices – Sales and income down from October, full year sales expected to improve but income to fall.

Music – Sales up from October forecast, thanks to Recorded Music. Full year sales and income expected to rise significantly.

Beyoncé’s new album…sold 2.3 million equivalent album units…by December 31, 2013. The Recorded Music business concluded the current quarter…with strong results.

Financial Services – Sales in come will exceed the October forecast, full year will increase significantly. Market fluctuations are expected this forecast, change is expected.

…business continued growing as its customer base is expanding. The rise in the Japanese stock market…had a positive impact, and Financial Services continued significantly contributing to the consolidated results.

Pictures – No change is reported from the October forecast, no more details given.

In Media Networks, Sony continues to expand its global footprint…launched AXN Black and AN White as a part of AXN Central Europe…first carriage agreement with British Telecom to make Sony Entertainment Television available…In Vietnam, Sony plans to launch a new channel GEM in 2014.

Captain Phillips, an Academy Award nominee for Best Picture, and American Hustle, an Academy Award nominee for Best Picture and the Golden Globe winner for Best Picture – Musical or Comedy, were released in the current quarter, and both are performing well at the box office.

Sony’s The Blacklist was the most watched new drama in the U.S. in the current season and already renewed its contract for a second season with NBC. Breaking Bad continues to be extremely popular…

The Pictures, Music and Financial Services segments are expected to continue to contribute stable profit.

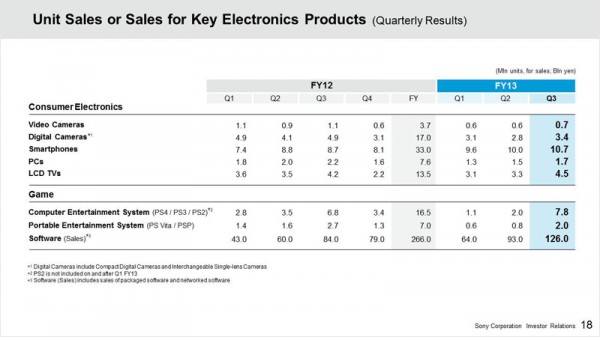

Unit Sales by Segment – PS4 Games Console, Xperia Smartphones, Tablets Leading

Game – The expected surge in system unit sales arrived with 7.8m from 2.0m in the previous quarter. This includes the PS4, Ps3 and PS2. Portable entertainment system sales sharply increased to 2m units from 800,000 in Q2 this year. Software sales (retail and online) matched the sharp increase to 126m units, up from 93m units in the previous quarter.

Consumer electronics – 10.7m smartphones sold in Q3, up from 10m in Q2. Note, the smartphone sales aren’t impacted by a once-in-ten-years boom, so quarterly and yearly unit sales record more slight increases and decreases. Each quarter so far in FY13 is up from FY12. 29.6m smartphones have been sold in the three quarters this year, almost matching the four quarter figure of 33m in FY12. Full year smartphone sales are expected to be down 2m to 40m ending the full Fy13.

PC unit sales are down from the small figures in FY12. This divisions decline is marked.

LCD TV unit sales are slightly lower than last year.

Digital and video cameras follow suit with a decline in unit sales from last year.

Acquisition

The management topics noted an acquisition of Tsuruoka Factory assets to “reinforce production capacity of CMOS sensors”. Other notes such as the sale of Gracenote and M3 shares were more documented.

Stock Price – Up

The following week is needed to get the full reaction, but as of the report today, the stock price up. This is positive investor reaction.

Final Note

Which will get more media (and investor) attention, the strong PS4/Xperia sales or the PC sale and TV divestiture? It could even be the sizeable jobs cuts related to PC/TV. It can’t be overstated: the PS4 took years of R&D money and Sony would not have survived (probably) if the Ps4 were a failure. Thankfully, it wasn’t, and it spent the year outperforming the rival, from annoucnement to unit sales. The Vita felt an uplift of sales inline with the PS4 arrival. That could compound sales.

The Xperia business has gained more global momentum, media adoration and new customers. Despite that, the sales forecast drops by 2m units for the full year to 40m. Any drop in sales forecast isn’t brilliant, but, many established competitors are counting their dollars, questioning survival and Sony Mobile has outperformed each quarter YoY. Mobile is targeted as a key pillar by many companies given its growth potential and the sale price of Nokia reveals how coveted success in this area is. 40m units (forecast) is good, with the first three quarters of this year almost matching what it took four quarters in FY12.

All other divisions except devices reported a quarterly rise. Some figures might seem small at 6/7% but should not be underestimated. An overall rise is positive and brightens the outlook. Sales and operating income are stable in the other divisions (Music, Pictures, Financial even Imaging and Home Ent.)

The PC figures over the past numerous quarters tell the whole story. Any attempt to keep it in-house would have faced tremendous obstacles. The TV figures are also unimpressive, somewhat matching the PC woes. Companies as old as Sony know that it has to ‘innovate or die’. The sale of the PC business is a bold move. It should appease investors somewhat. The financial results explained that the company will not meet its goal of restoring the TV division to profit ending this financial year. The hefty job cuts (5,000) to be made by the end of the FY14 will make headlines. About two thirds of these are overseas. The main questions needing an answer when that comes up are; is this necessary? (yes) is this the right thing to do? (yes) was it possible to avoid job cuts in this reform? (very unlikely). But, crossing into the next year in three months time, CEO Kaz Hirai will have two threats to his (monitored) job performance eliminated: the PC and TV drag. Investors will look at a company that is willing to prune an unhealthy branch off the tree. The rise in the Sony stock price reflects this. The other results provide deserved cheer.

You can find the full report at Sony.

Discuss:

Are PS4, Xperia sales strong enough? Was Sony correct to sell the PC division and detach the TV division? Is the CEO making the right moves?