Sony made a loss of $785 in the past quarter, despite a 7.2% jump in revenue on the same period in 2013. The Mobile division reported a loss of $1.58 billion. From those figures, it’s clear that other divisions paid for Mobile’s loss. One division in particular has come out most profitable, and it wasn’t the PS4-making Game business.

All of Sony’s key businesses performed well, turning a profit in the last quarter, Pictures being an exception, but Mobile was the real black hole where profit should have been. As the rhetoric goes, the PS4’s sales saved Sony in the last quarter.

Other mobile giants have been suffering too, notably Samsung’s quarterly profit dipped 49% in the last quarter. That’s one point the media beating on Sony which isn’t being reported as loudly. Clearly, whatever is going on in Sony’s Mobile division, isn’t exclusive to Sony. Sony’s mobile sales took a plunge – but the culprit wasn’t just the Chinese market, there was a bigger surprise.

How well are the other businesses doing and what’s going on in Sony’s Mobile house?

Update – ‘Sony loses ¥3 billion for every yen the Japanese currency falls against the dollar’ – Sony Corp. CFO, Kenichiro Yoshida.

We had debated whether it would be right to shrink our presence in the world’s largest smart phone market, but have judged what we need to do right now is to rebuild the business structure

Sony Corp. CFO, Kenchiro Yoshida

Those Chinese vendors, that are emerging around the world, they focus on price and trying to provide the best quality to users at the lowest price, They mainly try to compete directly with Apple in the high end of the market, and they struggle to convince Apple users to move to the Sony Device,

Francisco Jeronimo, research director at IDC

Investor confidence – Sony shares have held up high despite the reported loss. See end of article for the year-to-date chart.

The News in 30 Seconds: Almost all divisions were profitable, Pictures almost broke even but Mobile suffered a big loss. PS4s sold very well but there is a new king of Sony’s profitable businesses – Devices.

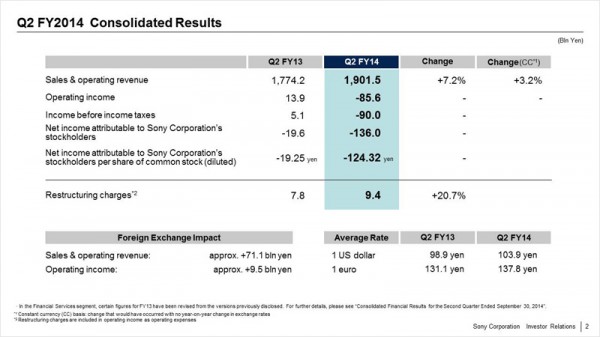

The Initial Figures

- Sales and operating revenue are up 7.2% on the same period last year

- Operating income – 13.9bn yen a year ago to -85.6bn yen (total income – total costs)

- Income before taxes – 5.1bn yen a year ago to -90.0bn yen in the past quarter (as above with taxes included)

The massive gap between the increase in operating income (sales) to the black hole where operating income should be (profit) says that sales are good but money is being lost somewhere. So where is money being lost?

Note – restructuring charges are on the rise up 20% year on year to 9.4bn yen. Sony seems to have a semi-permanent fund set aside for ‘modernising’ business which need to catch up. The idea that other Chinese manufacturers are ‘more nimble’ seems accurate, remembering that Sony’s TV business lost money for 10 years straight before the corporation decided to spin it off. Slow-moving corporations like Sony are destined for ruin in the age of ‘market disruptors’ if they don’t speed up.

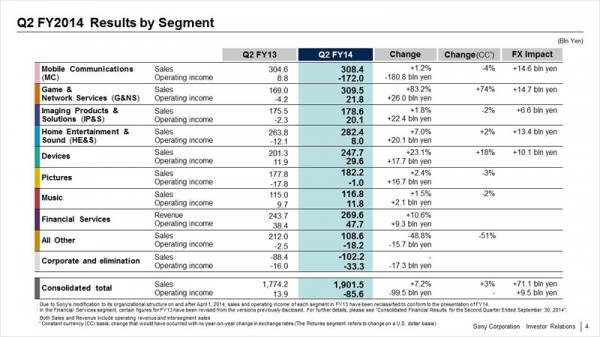

Results by Segment

Profit-making Businesses

- Game and Network Services; 26bn yen rise on the same period last year

- Imaging Products & Solutions; 22bn yen jump

- Home Entertainment and Sound; 8bn yen jump

- Devices; which includes smartphone camera lenses, posted a 17bn yen rise versus the same quarter last year

- Music; yep Music made a profit while Mobile didn’t. 11.8bn yen profit

- Financial Services; 47bn yen profit

Loss-making Businesses

- Mobile; 180bn yen fall on the same quarter in 2013

- Pictures; including film-making, made a loss of 1bn yen, which is a dramatic improvement on last year

- All Other; 18.2bn yen loss for whatever is hiding in that grey area

- Corporate and Elimination; a loss here and this section is new. What’s hidden in here?

A couple of things are clear:

- The most profitable division in Sony this past quarter is Devices. Note that Devices covers smartphone camera sensors, including the one Sony supplies to Apple for various iPhone models.

- Almost every business made a profit. All Other is a financial junkyard and we’re not privy to what’s in there. Pictures, while it made a loss, it vastly improved its performance on the same period last year and was very close to making a profit.

- Mobile (including Tablets and Smartwear) is the financial sinkhole now.

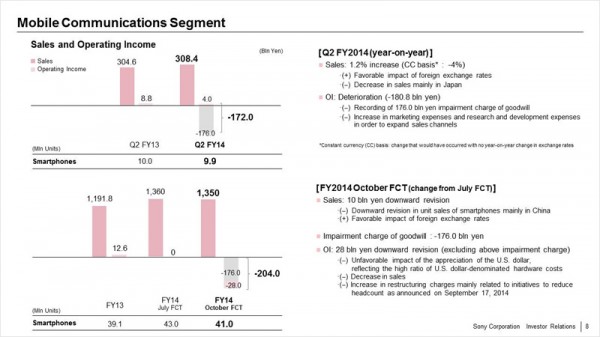

Mobile – What Happened?

Click to enlarge

Last month, Sony wrote down the value of its mobile phone business by 176 billion yen ($1.6 billion). This is a terrible loss given that Sony’s Xperia brand is finally getting global recognition and the flagship smartphone Xperia Z3, despite being a smaller upgrade from the Z2, seems to have wowed the tech reviewers everywhere. The Mobile division has been listed as one of the three ‘priority divisions’ for some time now. The crumbling of one of them (rather than a smaller, less important venture) is dangerous for corporate stability. Noting that up to 60% of Samsungs quarterly profits are linked to mobile, so a fall in mobile leads to a fall in chips, sensors, LCDs and more.

What did Sony have to say about Mobile in its report?

For the bigger changes in the Mobile division compared with 2013, Sony says in their report: “Decrease in sales, mainly in Japan” and “recording of 176bn yen impairment charges of goodwill”.

For changes since the past quarter: “Downward revision of unit sales mainly in China”.

The Chinese sales tumble is more recent, but the Japanese market sales must be a surprising and uncomfortable development considering Sony always performs well on its home ground.

There are bigger influences affecting Mobile though, more on that after the PS4 news.

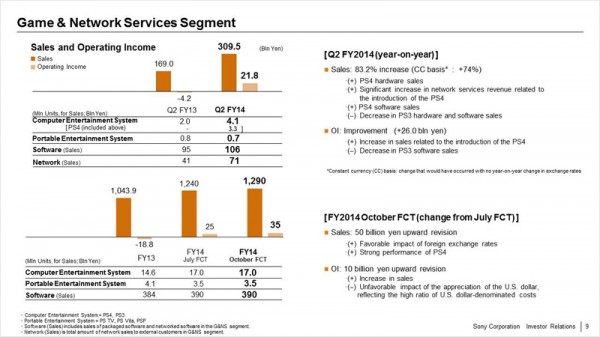

How Well is the PS4 Doing?

- 83% increase in sales (PS4, PS3, games, more) vs Q2 2013

- 7.9m PS+ subscribers to date

- 3.3m PS4 consoles sold in this quarter, bringing the total to date to 13.5m

- 800,000 PS3 consoles sold this quarter

- 3.5m portable console sales, this number continues to fall

The only thing to watch out for, is that Sony is now planning to launch the PS4 in China in 2015, rather than 2014 as previously indicated, while Microsoft has already launched the Xbox One in China. Other than that, pop the champagne corks.

Broader Influences on Sony’s Overall Performance (Incl. Mobile)

Restructuring – the ‘hedgetrimmer’ CFO, Kenichiro Yoshida told a press briefing last Friday: “We are on our way to achieving 400 billion yen in operating profit next year,” “Restructuring is progressing well and right now we think we will be able to cut 20% of staff at our distribution companies and 30% at headquarters.” So the new CFO is trying to push overall revenue higher, but he is aiming to cut staff too.

Mobile – Sony is backing out of China, despite selling more smartphone sensors to Chinese manufacturers. Central Finance Officer (CFO) Yoshida also said that Sony Mobile will no longer produce China-only handsets. Why did they not stick to Europe, where Sony Mobile’s footprint was strongest? They commented before that they were avoiding the US because it didn’t play to their strengths, mentioning huge start-up costs, but then they jumped into China (and the US, after all).

What happened in the past quarter (and likely beforehand) is simply epic mismanagement. Besides the fact that the finances were let out of control, the strategy and implementation failed terribly. Writing down a $1.6bn on that division last month followed by comments to ‘minimise exposure to the Chinese market’ shows failure.

Sony’s next plan for Mobile is to place a new chief named Hiroki Totoki who is apparently regarded as a successful ‘business rebuilder’ and was supposedly hand-picked by the chief executive Kaz Hirai.

A top fund manager, Hideyuki Fukunaga, said of the new Mobile chief:

Sony’s got the will to continue with its smartphone business and it’s hoping income from the business improves. Todoki has reformed businesses before, so he’s probably thinking of rebuilding it,

Even if this guy is respected for ‘rebuilding’, he might be short on time. Since Sony has lost money on 7 of the past 8 years in business, at some point, the banks are likely to stop the credit line. Or, investors might back out first. But, the investor movement is less likely to happen. There could yet be a spin-off.

Japanese Economy Falling Behind Again – Japan itself has financial problems, with an $11 trillion debt level, equivalent to nearly 240% of GDP. As for national economic policy, which has a direct and significant impact on its many exporting companies such as Sony, ‘Abenomics’ is increasingly considered as no longer working. A year ago, ‘Abenomics’, the nickname given to the new Prime Minister Shinzo Abe’s economic plan to boost the economy, seemed to doing some good, but that has possibly collapsed.

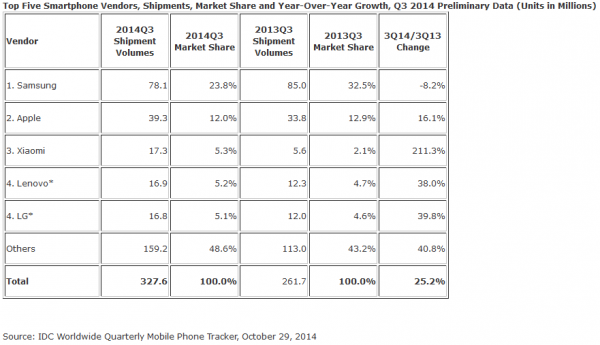

Samsung’s Profit in Trouble – As we previously covered, Samsung’s quarterly profit dipped 49%, igniting a restructure of its mobile business. Samsung, if you’re still reading this, you already know leads global smartphone sales, particularly Android where it dominates. If the leader goes off course like that, Sony is not entirely to blame. The rhetoric is that Sony, Samsung and others are falling victim to more nimble, efficient, cheaper Chinese rivals like Xiaomi and ZTE who are performing well, with Xiaomi now ranking 3rd highest-selling smartphone manufacturer globally.

While a quaterly loss was reported, Sony has not downgraded its profit forecast for the full year ending March 31 2015, predicting a full-year net loss forecast at 230 billion yen.

Sony’s shares are still in the area of a high since the start of 2014, holding at $19.70 at close on Thursday 6th November, almost $5 higher from year lows in February despite the Mobile loss.

Click to see in full screen view Yahoo Finance

Click to see in full screen view Yahoo Finance

Sony’s results can be seen in full here.

Discuss:

What can Sony do to repair the Mobile division?