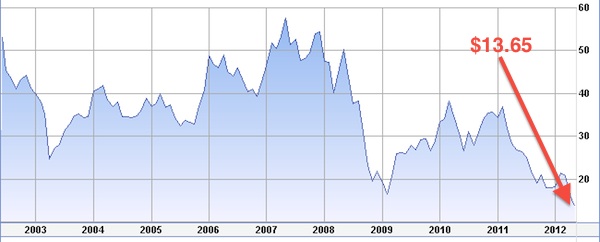

Unless you happen to be one of the Sony execs who ignored the transition to smartphones, tablets, and did little to properly prepare the company for the LCD television wars, you know that the company has been in trouble the past few years. After reporting a record $5.7 billion annual loss, (its fourth year to post such losses), the company stock hit a new 25 year low with share prices dipping below $15. Sony has promised that 2013 will be the year they are able to turn back to profitability but with another year of potential losses ahead of the company, even if their turnaround plan works, the company has years of losses to make up for while its competitors sit on piles of cash. With a wave of new portable devices likely to hit from Apple in the next few months and the company’s rumored entry in the television business while Samsung continues to offer more competing products, analysts have downgraded Sony stocks from hold to sell, citing:

company’s weaknesses can be seen in multiple areas, such as its feeble growth in its earnings per share, deteriorating net income, disappointing return on equity, poor profit margins and weak operating cash flow.

More details after the jump.

With loss of market share and low profit margins, Sony has seen a steep decline in earnings per share in the most recent quarter. With earnings per share have declined for the past two years, many still believe the worst is yet to come as the company reported poor results of -$3.14 versus -$0.43 in the prior year.

In fact, some believe that next year, the market is expecting a contraction of 107.3% in earnings (-$6.51 versus -$3.14). Other troubling news surrounds Sony’s net income which has significantly decreased by “329.2% when compared to the same quarter one year ago, falling from $901.20 million to -$2,065.49 million.” Perhaps most troubling for Sony is their gross profit margin, meaning how much they make on each device sold which is currently extremely low, coming in at 3.90%. This roughly translates to Sony making almost $4 on each $100 they sell, versus Apple who commands between a 40-50% profit margin. All news however isn’t doom and gloom as:

SONY CORP is still fairing well by exceeding its industry average cash flow growth rate of -71.16%.

Discuss:

With Sony shares down nearly 22% year to date, is this a good time to invest in the company for long term gains or is there more pain to come?

[Via The Street]