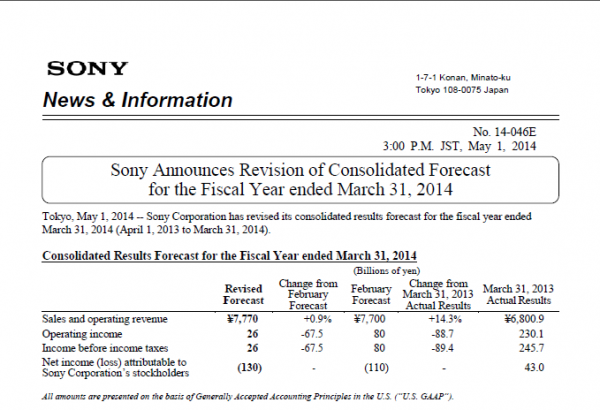

The full year results for the fiscal year FY13 are in and Sony is suffering a loss accounted to the PC business and a fall in demand for disks. Sales and operating income are up on last year yet net profit has been eroded, with a loss of ¥130bn / $1.27bn / €929m. Sony cites that costs related to the PC business continue to drag profit downward as they prepare to wind down their VAIO division and sell off the brand.

Read on for the full story.

Finally news on Sony’s performance for the previous fiscal year are in, and the corporation still faces headwinds while trying to stay in the black. The good news is that sales and operating revenue are up ¥1bn from the previous year, the bad news is that despite this, result is still a net loss. After a stellar performance with the launch of it’s prized PlayStation 4 console with 7 million sold so far, guiding the project from initial public showing to post-launch window should have accumulated a boon for the corp. While smartphone sales were predicted to be just slightly below target for the full year, that still represents a significant gain on the previous year and the Xperia brand continues to grow in value and popularity. Despite this, all eyes will likely be on the financial sinkholes because the year 2013 has produced a net loss.

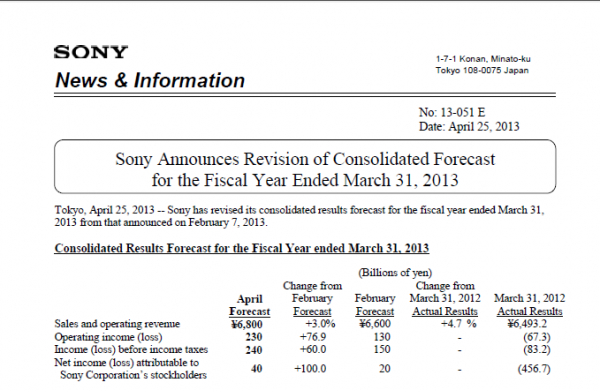

Compare FY13 above with FY12 below:

The changes are obvious – the rise of sales and operating revenue since FY12, yet FY13 has still resulted in a loss. Where’s the profit going?

The sinkholes

PC Business

Sony says in the initial full year report:

Sony expects to record approximately 30 billion yen in additional expenses in the fiscal year ended March 31, 2014 related to exiting the PC business.

Since Sony’s announcement…that it will exit the PC business, PC sales…expected PC sales…are underperforming the February expectation.

Consequently, Sony expects to record write-downs for excess components in inventory and accrual of expenses to compensate suppliers for unused components ordered for Sony’s spring PC lineup.

However, there has been no significant change to the expected total charges relating to Sony’s withdrawing from the PC business as the increase in the costs recorded in the fiscal year ended March 31, 2014 will be offset by lower costs in the fiscal year ending March 31, 2015.

Does Sony have enough balloons to keep the house afloat? (Disney Pixar Up)

Analysts and credit rating agencies will not be forgiving when they read both a small profit before taxes and that the PC business is still acting like a brick tied on to the end of the Sony balloon.

Disc Manufacturing

Sony expects to record approximately 25 billion yen in impairment charges mainly related to its overseas disc manufacturing business.

Primarily due to demand for physical media contracting faster than anticipated, mainly in the European region, the future profitability of the disc manufacturing business has been revised. Consequently, Sony has determined that it does not expect to generate sufficient cash flow in the future to recover the carrying amount of long-lived assets, resulting in an expected impairment charge.

So, the ‘digitialisation of media’ is accelerating, in this case Sony references Europe changing media format/usage and Sony is having to both adjust to this and write down losses as a result. This will add more attention to Sony’s plans for the PS4, the expansion of digital downloads. If Blu-rays are losing steam, then Sony needs to be seen as fully prepared and able to operate in the modern, digital realm.

We haven’t forgotten either that the Chief Financial Officer Masaru Kato recently stepped down or the surprise PC/TV changes.

You can read the full report from Sony here. Come back for a closer look when the full details are made available later this month.

Image credits – headline image is of the hi-tech business district, Shiodome, Tokyo. Courtesy of Tokyo Express.

Discuss:

What do you think of the initial financial results?