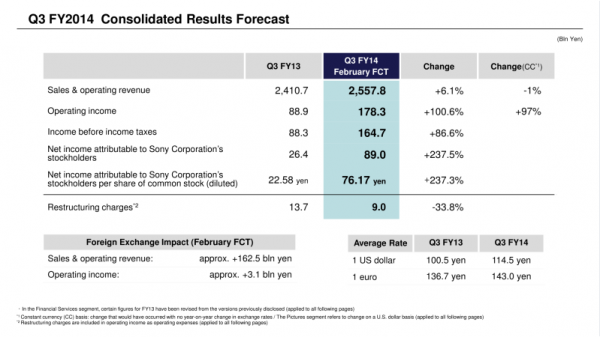

Sony has finally posted the results of its third quarter for the financial year 2014 ending this March. The results were delayed as a result of the recent Sony Pictures hack. Sales and profits were double analyst expectations, with a profit of ¥178 billion ($1.5 billion / €1.3 billion / ₹93 billion) for the quarter. Operating income was up a whopping 100% year-on-year with net income up 237%. The full year net loss predicted was trimmed, owing to the a healthy performance in the past quarter.

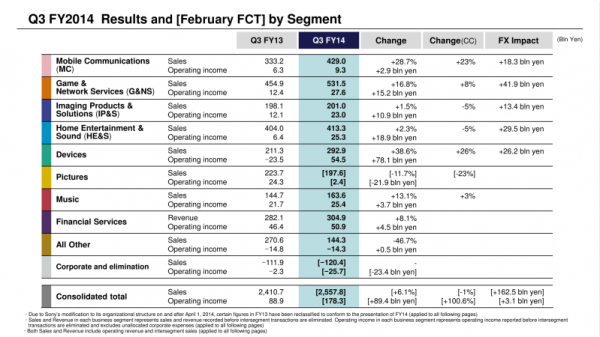

Financial services have again become Sony’s most profitable segment. #2 is Devices, which includes smartphone camera sensors – e.g. for rival smartphones. The corporation’s margin, the profit based on sales, was the best since 2007.

Has Sony’s new Central Finance Officer steered Sony back on-track? Read on for the full results from the Sony Q3 2014 financial results and some analysis.

Q3 Results Overview

Key Figures

- Sales of ¥2.5 trillion ($21 billion / €18 billion / ₹1.3 trillion)

- Profit of ¥178 billion ($1.5 billion / €1.3 billion / ₹93 billion)

Segment Analysis: Q3 and Full 3 Quarters to date

Profitable Segments (Before Taxes)

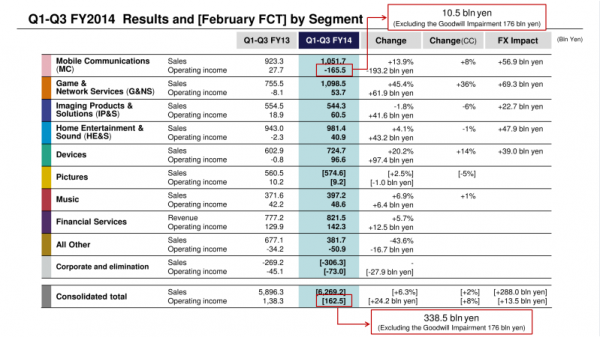

- Mobile – Q3 sales were up 23% on the same quarter last year, profit up one-third. Loss for Q1-Q3 in total of $1.4 billion / €1.2 billion / ₹86 billion.

- Game – sales up 16% on same quarter last year, profit more than doubled year-on-year (YoY), 3 quarters this year sales up 45% with a profit of $451 million / €394 million / ₹27 million.

- Imaging – sales up 1.5$ YoY, profit up 10% YoY. Full 3 quarter profit of $511 million / €7.4 million / ₹31 million.

- Home Entertainment – see below.

- Devices – see below.

- Pictures – sales down 11% YoY, profit shrunk 21% YoY. 3 quarter loss of $8.5 million / €446 million / ₹526 million.

- Music – see below.

- Financial Services – see below.

Unprofitable Segments (Before Taxes)

- All Other

- Corporate & Elimination

Q1-Q3 Results

- Sales & operating revenue up 6.3%

- Operating income up 17%

- Income before taxes up 3%

Exports, Finances, Strategy, 2014 Trends

Economic Factor

The Yen is very weak, this makes it cheaper to export. That’s a natural advantage for Sony’s exports. It’s clear throughout the results that the weak Yen has significantly helped sales.

Finances Finally Showing a Turnaround?

We said that we will carry through structural reforms, that there would be no sacred cows. It is taking time, but I think we may be starting to see results,” he told an earnings briefing.

Chief Financial Officer Kenichiro Yoshida

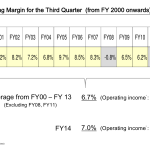

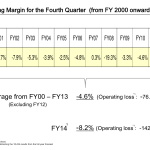

If Sony is expecting to make a loss for the full year 2014 next quarter, how can things be improving? It’s all in the detail. Sony has just achieved its best profit based of sales (margin) since 2007 (see right). This is a figure I’ve been complaining about for several quarters now. The rising sales figures for divisions doesn’t matter if costs get out of control. That’s why so many quarters surfaced a loss. This definitely is a sign of a better controller of finances. CFO Kenichiro Yoshida just needs to keep that margin high to convince investors of a good grip on finances. It would also help if hackers stopped releasing their products to the world ahead of time.

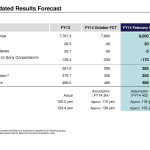

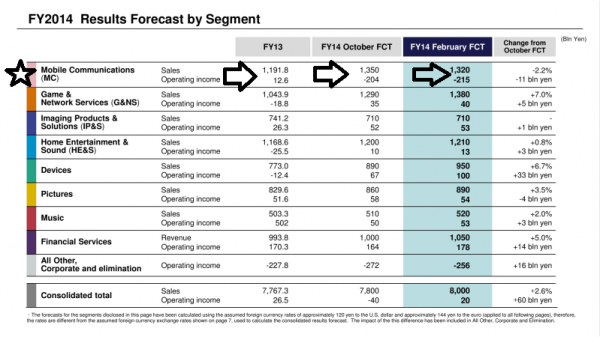

The full year finances (see left) are showing an improvement also, after that horrific Q2. Sales are now expected to have risen 2.6% (OK no blowing up the celebration balloons just yet) and a pre-tax profit forecast for the full-year, compared with a FY13 loss (ending March 31 2015) of ¥20 billion ($170 million / €148 million / ₹10 billion). It’s the tax and shareholder obligations which eat into that profit. Of these two, paying shareholders dividends is the ‘optional’ choice, but shareholders values are simple – receive a dividend on the shares they bought. Sony is increasing its dividends after its previous quarterly decision to not pay a dividend for the first time since it began in 1958. The return of the dividend combined with the improving finances should please investors somewhat. This is relative, of course. The improvement is related to the previous quarter and previous year for example, not comparing apples and oranges with say the profits of rivals.

The 4th quarter apparently isn’t Sony’s best. They have an uphill battle to make good of the three months Jan-Mar 2015 (for financial year 2014) to keep the improvements.

Strategy The CEO Kaz Hirai is going to reveal a new strategy on February 18, according to the company. This will surely elaborate on his speech at CES in January where he hinted of major changes to come, including a possible joint venture for the Mobile segment.

Mobile – Profit or Loss? Mobile made a profit in the most recent quarter to December 31, but a loss for the 3 quarters to date for fiscal year 2014. Looking at the performance compared with 2013, sales are up but costs have exploded. The mobile chief has a lot to answer for. 2,100 – the number of job cuts in the mobile segment. The corporation as a whole is fighting each quarter to prove its relevance and financial stability, and it can’t afford unexplained cost explosions. The Year 2014 Trends so Far (Q1-Q3)

The Year 2014 Trends so Far (Q1-Q3)

- Game has turned a profit, after making a loss the same quarter last year.

- Imaging sales are down very slightly but profit has doubled.

- Home Entertainment has turned a profit, after losing money last year in the same three months.

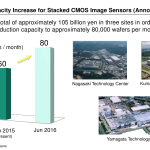

- Devices (including smartphone camera sensors, think rival manufacturer smartphones) has produced a sharp swing back into profit. CMOS camera sensor production is set to increase. See right.

- Pictures (film/movie theatre) has brought in increased sales and higher profit, despite the hacking madness.

- Music sales are similar with last year but profit has collapsed. This segment has been running fine for many quarters, but needs attention now. Sony spends so much time fixing one segment to find another has suddenly fallen apart.

- Financial Services (life insurance in Japan) slightly higher sales, slightly lower profits. No major change. Profit is good, financial services has returned to pole position, producing Sony’s biggest source of profit, even more than the PS4 for Xperia ZAnything.

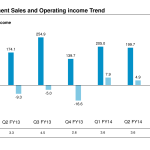

TV – Not a segment itself, but sales and profit are up in all three quarters so far this year compared with 2013. See right.

Investor Reaction – Sony’s stock price went up $2 after the results announcement and have maintained that level – that is an extremely positive reception from investors. At the time of writing, it gained almost another $2. This is impressive.

Source: Yahoo Finance

Source: Yahoo Finance

Full financial results available here.

Discuss:

Financial services make more profit for Sony than any other segment – again. Should Sony expand financial services? Smartphone sensor sales (especially sales to rivals) have rocketed, how can Sony build on that? How do they turn around the Mobile segment? Where is that profit going?