On Monday this week the Japanese branch of the investor ratings agency Moody reduced Sony Corp. stock from Baa3 to Ba1, leading to a tumble in the stock price.

On Monday this week the Japanese branch of the investor ratings agency Moody reduced Sony Corp. stock from Baa3 to Ba1, leading to a tumble in the stock price.

This news has produced mixed reactions. Moody’s report predictably targets falling PC demand and the troubles that the TV division has had. Fortunately, these areas form a smaller part of Sony’s operating revenue than only a few years ago thanks to years of cost-cutting measures and a reorganisation that targeted higher growth-potential areas such as smartphones, tablets and the gaming sector. Additionally, newer streams of income have been sourced in insurance and medical devices.

What exactly did Moody’s evaluation take issue with?Highlights from Moody’s report:

The restructuring, reorganisation and refocusing has been recognised and perhaps the outlook would have been worse if Sony hadn’t engaged in this in the past number of years:

…Sony has made progress in its restructuring and benefits from continued profitability in several of its business segments…

The main concerns in the TV and PC businesses are highlighted:

Of primary concern are the challenges facing the company’s TV and PC businesses, both of which face intense global competition, rapid changes in technology, and product obsolescence.

So much of Sony’s sales and profit is made up by TV and PC?

Strengths and weaknesses

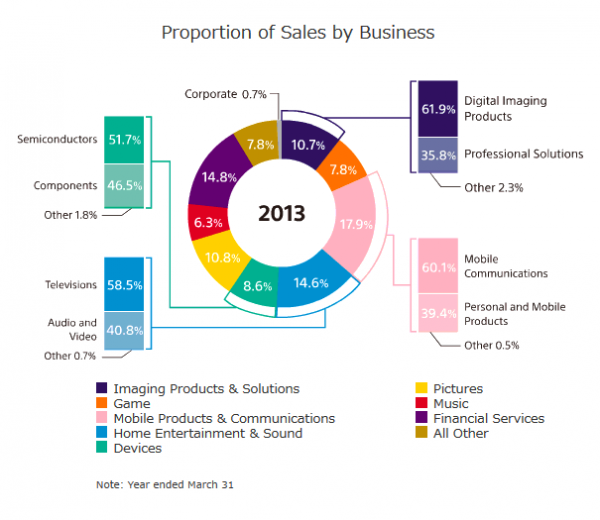

The last full financial year puts TV at slightly more than half of the Home Entertainment & Sound segment which constitutes 14.6% of sales for the previous year. PC sales are a part of the Mobile Products & Communications segment, of which less than half of this is PC with smartphones and tablets instead dominating this segment, which has a 17.9% part of total sales in Sony Corp.

These seem to be small percentages to downgrade a corporation’s rating, or being troubled about obsolescence. If the entire MP&C segment was composed of PC sales or the entire HE&S segment composed of TV sales, great concern would be justified.

The bullish performance of Sony in the mobile space shouldn’t be underestimated either. Each year since its smartphone direction took shape in 2010, the company has gained in sales and market share, taking a crucial grip in Europe and now starts 2014 embarking on an American-market assault – at a time when misfortune struck the less well-prepared BlackBerry, HTC and Nokia. Microsoft, with an annual revenue count of almost $78bn in 2013 can only look enviously at Sony, packing a sledgehammer with a fraction of the financial firepower.

Courtesy of DreamWorks Pictures

Other, financially comfortable companies, resting from past success can look at Sony and wonder.

That’s not the only space that Sony is outperforming expectations. Wind the clock back one year and the business journalism arena wasn’t short of predictions of how this generation of consoles was irrelevant because of the arrival of real mobile gaming on smartphones. It is necessary to look forward and plan appropriately, but the doomsday profits calling Sony’s bluff in the gaming business were about as accurate as Microsoft’s bet on touchscreen taking over the PC industry when it introduced Windows 8. Console gaming is still here to stay and is as valuable as ever, totalling $93bn last year. Sony has maintained momentum since it ignited the new wave of gaming this time last year.

Sales potential exists in console gaming as long as the industry maintains relevance and continues to inspire. The hype and sales to match suggest the PlayStation brand continues to tickle the imagination and entertain the masses, much like Hollywood.

The profitability of the Mobile and newcomers like Financial Services as well as the increasing interest in medical suggests that Sony is lookin![]() g forward to future high-innovation segments and supplying the investment to feed these interests.

g forward to future high-innovation segments and supplying the investment to feed these interests.

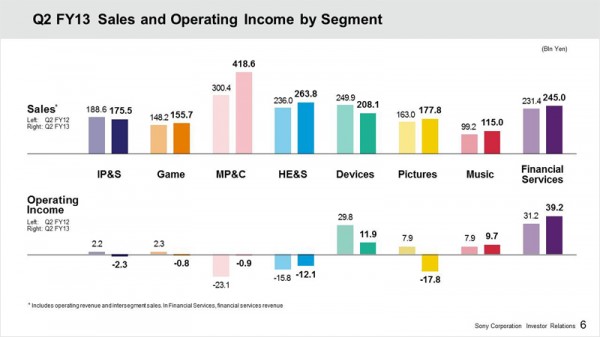

The most recent quarterly data, Q2 FY13 supports the company’s success with smartphone growth and illustrates the strengthening financial services division amidst a generally stable backdrop.

What the investors want (in Moody’s assessment)

According to Moody’s assessment, the problems are:

Sony’s profitability is likely to remain weak and volatile, as we expect the majority of its core consumer electronics businesses — such as TVs, mobile, digital cameras and personal computers — to continue to face significant downward earnings pressure.

Agreed that investors want to see Sony’s strengths play out in the numbers. The pressure is on Sony Corp. CEO Kaz Hirai to continue to stabilise the TV and PC businesses while reaping the benefits from high-growth areas.

The primary reason is intense competition and the shrinkage in demand, the result in turn of cannibalization caused by the rapid penetration of smartphones.

Intense competition hasn’t presented a problem for Sony since 2010 in smartphones with sales, market share and brand image uplifting. Let’s hope that Sony doesn’t face the same odd pressure from the market that Apple did, in having to reinvent the wheel in each new flagship or face a fall from grace with stock price. If Sony delivers with its targets in smartphones, the strategy shouldn’t be a major concern.

To improve profitability, Sony has implemented extensive restructuring measures that include — among others — the reduction of fixed costs for its TV business, and the consolidation of its manufacturing plants.

As considered above, the efforts have surely paid off for Sony in the past number of years. These efforts have shown that the corporation is changing with the market. The real bottom line is that a company that isn’t doing this wouldn’t still be here.

Final word

It seems surprising to take concern at a time when the newly launched PlayStation 4 is tearing the competition apart and Xperia smartphones broaden to a larger global market share position nearing third place. Everyone can probably agree however that the next two quarters need to deliver strong financial results to resist market pressure and prove that the company is stable. The real concern has probably come from cooler financial results later in the 2013 financial year after such a warm start. The next quarterly results will likely be boosted by the strength of the gaming division and if the TV and PC areas are managed well then concerns will likely recede.

![]() Note from Sohrab Osati

Note from Sohrab Osati

Editor-in-Chief

Like Jonathan, I find the recent downgrade by Moody a bit odd. Many of the negative factors that Moody is pointing toward, like a weakened TV business, have by now been reflected into the stock and value of Sony for many years. In fact, it seems that Sony’s troubled television business hit a peak a few years back and the division has continued to bounce back. The trace of this recovery can partially be seen in the restructuring that Sony has undergone, which saw the company sell its LCD manufacturing plants in order to secure better LCD pricing with lower risks. At the same time, Sony has also reduced their television line and made it easier for consumers to identify with, while previously, the company offered at least 10 different lines of TVs in a dizzying and confusing manner.

This of course doesn’t mean that the television division is doing well compared to, say, Samsung. However, the massive losses from the television division have mostly ended and sales have begun to pick up. Equally, most agencies tend to look at not where a company is but where it’s going and Sony’s aggressive push into 4K should be a good sign. While it will be some time for massive adoption, Sony will by mid 2014 have three different lines of 4K television which still command a higher profit margin than traditional LCD televisions which have little room for profit compared to a decade ago. This leaves Sony in a good position to reap the benefits from the eventual transition to 4K and will likely see them hold a strong market share.

In regards to Sony’s PC division, the reasoning gets even more bizarre. While companies like HP and Dell live and breathe by their PC divisions which do large numbers, Sony has never commanded such a presence with their PC division. In fact, the VAIO brand has never enjoyed even a 1% market share in global PC sales. Equally, VAIO has never been a player in the lucrative corporate world which can bring in large sales volumes. Seeing how, from its inception, VAIO has been a high-end brand that hasn’t directly competed with other manufacturers (this isn’t to say that Sony didn’t strive for a larger market share but that it just never panned out for them), it seems odd to use that as a reason to downgrade Sony. Furthermore, the contraction in PC sales has affected the entire PC market place and Sony has faired better than the rest if nothing more than for the ironic reason that they never sold in huge volumes and therefor never relied on VAIO sales as a make it or break it division for the company.

While Sony is far from being in a healthy spot compared to their competitors, the company has made huge strides compared to where they were a few years ago. Factoring in the company’s big growth in mobile, the continued success of the PlayStation brand with the PS4, and an aggressive push in wearables with devices like the SmartBand, and their 4K efforts, the future certainly seems far more brighter and sustainable for Sony than Moody depicts.

Discuss:

Do you agree with Moody’s outlook on Sony? Will the PC and TV businesses pose more trouble? Will PS4 and Xperia sales lift expectations?

[Via Bloomberg]